Texas has lots of banks and one of the most interesting is the State Infrastructure Bank (SIB).

Texas was one of 10 states chosen to participate in the first pilot SIB program following passage of the 1995 National Highway Designation Act. That legislation authorized SIBs as financial options that local governments could take advantage of through state transportation departments. A lot has happened since then. For many years, SIB activity was greatest in just five states – South Carolina, Arizona, Florida, Texas and Ohio. Now, there is lots of activity in many states.

Research by the National League of Cities predicts that by 2020, 40 states will likely have infrastructure banks. Citing proper financial planning as necessary for keeping up with current and future infrastructure needs, SIBs are becoming an increasingly popular financial tool for local government entities because by leveraging federal resources, local public officials can move forward on critical projects rather than waiting and hoping for funding of some sort.

Research by the National League of Cities predicts that by 2020, 40 states will likely have infrastructure banks. Citing proper financial planning as necessary for keeping up with current and future infrastructure needs, SIBs are becoming an increasingly popular financial tool for local government entities because by leveraging federal resources, local public officials can move forward on critical projects rather than waiting and hoping for funding of some sort.

In Texas, the Department of Transportation (TxDOT) oversees the revolving loan fund in the state’s infrastructure bank. It was initially capitalized with a little more than $170 million. The money came from federal funds and from the State Highway Fund. TxDOT approved nearly 100 SIB loans with a cumulative total of approximately $483 million. That investment, according to TxDOT, leveraged more than $3.6 billion in Texas transportation projects.

Local governmental entities in Texas were allowed to use SIB funding for projects such as planning and preliminary studies, construction engineering, utility relocation engineering, design construction, feasibility studies, economic and environmental studies, right-of-way acquisition and surveying appraisal and testing.

The Texas SIB offers long-term funding and loans without underwriting, banking or rating agency costs. Public entities can take advantage of flexible repayment terms. Counties determined to be “economically disadvantaged” may qualify for even more reduced interest rates.

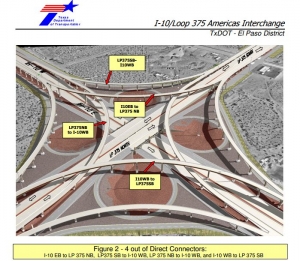

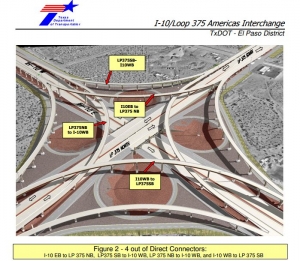

The Camino Real Regional Mobility Authority benefited from a loan made by the Texas SIB. A $156 million project for direct connectors at I-10 and Loop 375 was awarded a $30 million, 30-year SIB loan to help defray costs of the project. Similarly, the city of Mesquite borrowed $5.6 million in SIB funding over a 12-year term to help augment a $37.3 million I-635 improvement project.

Other states also have opted to create SIBs. In fact, more than half of the states now have SIBs. While highway projects generally draw more favor from SIBs, other infrastructure projects can also be granted loans.

In Rhode Island, the state infrastructure bank is a quasi-public entity that serves as the financial administrator of the state’s clean water and drinking water revolving funds. The SIB issues bonds to finance municipal sewer and water utilities projects.

Nebraska’s legislature is studying a bill that would create a $450 million infrastructure bank in the state to address major highway projects. Officials are hoping to expand a local highway in Columbus with funding from the bank. They indicate that the two-year construction project would generate $195 million in economic activity and create about 700 jobs.

It’s encouraging to see more alternative funding options. The state’s economic prosperity depends on sound infrastructure and progressive thinking. Let’s hope that many states discover the positive attributes of state infrastructure banks in the very near future.

SPI’s newsletters are excellent sources of information regarding government procurement news. Subscribe here.